Minnesota Mesothelioma Lawyers

Mesothelioma is a rare, deadly disease that is almost always caused by asbestos exposure. The companies that have mined and manufactured asbestos knew it was harmful but intentionally concealed this information for decades. If you or your loved one has been diagnosed with mesothelioma in the Upper Midwest, our award-winning mesothelioma lawyers can help you hold the manufacturer liable.

Scientists have known for decades that exposure to asbestos causes mesothelioma. In 1989 the EPA attempted to ban asbestos because of its devastating health risks. A federal appeals court later overturned the ban in 1991. As a result, asbestos is still used in some products, although it is more regulated now.

Mesothelioma is a rare and aggressive cancer that may not appear until decades after exposure. If you or a loved one has been diagnosed with mesothelioma, our Minnesota mesothelioma lawyers will help you understand your options. At Sieben Polk P.A., we work to hold asbestos-producing companies accountable for the harm they’ve caused. We provide consultations free of charge, and we never charge a fee unless we win.

- Choose an Experienced Mesothelioma Lawyer in Minnesota to Handle Your Case.

- Asbestos Exposure in Minnesota

- How Much Does It Cost To Hire A Mesothelioma Attorney in Minnesota?

- Who Is Eligible For Mesothelioma Compensation?

- Filing A Mesothelioma Lawsuit in Minnesota

- Our Award-Winning Asbestos and Mesothelioma Attorneys

- Mesothelioma FAQs

- Our Experienced Asbestos Lawyers Are Ready To Help

Choose an Experienced Mesothelioma Lawyer in Minnesota to Handle Your Case.

Sieben Polk P.A. is the only mesothelioma law firm located in Minnesota litigating on behalf of asbestos exposure victims. We have secured thousands of successful results for Minnesota and greater Midwest clients. If you or a loved one has been diagnosed with mesothelioma, it is important to promptly contact a Minnesota mesothelioma attorney to ensure your rights are protected.

We offer clients legal representation in a wide variety of asbestos-related matters, including:

- Mesothelioma

- Lung cancer and asbestos exposure

- Asbestosis

- Wrongful death claims

- Asbestos-related pleural disease

- Occupational asbestos exposure”

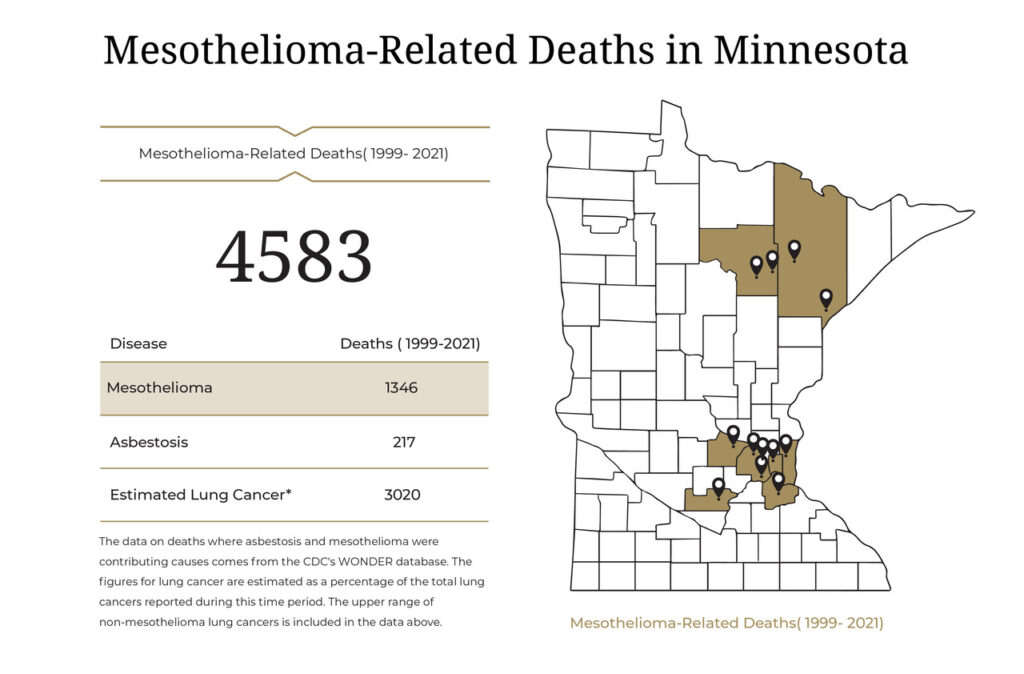

Asbestos Exposure in Minnesota

Because of its heat resistance and durability, asbestos has been used to make various products people use every day. When used in production, asbestos can create dust particles. When asbestos dust is breathed into the lungs or swallowed into the abdomen, mesothelioma can develop.

Common sources of asbestos exposure in Minnesota include:

- Iron mining

- Taconite mining

- Oil refineries

- Hospitals

- Schools

- Paper mills

- Conwed products

- Talc products

- Honeywell

- Northwest Airlines

People working in manufacturing plants that produce motor vehicles and construction parts are also at a higher risk of asbestos exposure. Some products containing asbestos include brakes, insulation, cement, drywall, flooring, roofing, paints, sealants, and plastics.

If you or someone you love has been exposed to asbestos or is showing symptoms of mesothelioma, seek medical attention immediately. You may also be able to bring a mesothelioma claim to receive compensation for your medical expenses.

How Much Does It Cost To Hire A Mesothelioma Attorney in Minnesota?

Our mesothelioma attorneys in Minnesota do not charge upfront fees for victims of asbestos exposure. Instead, we work on a contingency fee basis, which means we only charge fees if we win your claim and successfully recover compensation for you. If we don’t win, you owe us nothing.

Who Is Eligible For Mesothelioma Compensation?

You may be eligible to recover significant financial compensation for asbestos exposure if you are:

- A patient diagnosed with mesothelioma, asbestos lung cancer, asbestosis, or any other asbestos-related illness.

- The spouse, child, or other next-of-kin of someone who has passed away as a result of any asbestos-related illness.

- The estate representative of someone who has died of an asbestos-related illness.

Being exposed to asbestos does not in itself qualify you for mesothelioma compensation. You can only file a claim after the exposure has caused you harm that can be proven by a diagnosis.

Filing A Mesothelioma Lawsuit in Minnesota

Mesothelioma claims can be complex because the liable asbestos product manufacturers are usually large corporations that would rather use their assets to fight asbestos exposure victims than compensate them.

Filing an asbestos exposure claim is a process. You can count on our knowledgeable Minnesota mesothelioma lawyers to handle every step of this process so you can focus on your treatment and spend time with your family. The process of filing a mesothelioma claim in Minnesota includes the following:

- Case investigation. Once you have a diagnosis, the first step will be to identify all sources of asbestos exposure to ensure every company that contributed to your diagnosis is held accountable. We will interview you about your work history and tap into our databases to identify the liable companies on your behalf.

- Evidence against the asbestos product manufacturers. Since asbestos product manufacturers won’t voluntarily accept responsibility, you will need evidence to prove they manufactured the products that exposed you to asbestos. We already have much of the evidence you will need against these companies in our possession, and we will gather any additional evidence needed to support your claim.

- Analysis of your medical history. Asbestos companies will try to use your medical history against you in any way they can. They may blame your mesothelioma diagnosis on your genetic makeup or claim that your lung cancer was caused by something else. You can count on our skilled mesothelioma lawyers in Minnesota to thoroughly familiarize ourselves with your medical history so we are ready to thwart these tactics.

- Mesothelioma lawsuit. We will file a mesothelioma lawsuit on your behalf. The defendants will be entitled to review your evidence, including relevant medical records. You may be required to testify in a deposition or at trial. We can overcome this if your health makes it impractical. If you are required to testify, we will ensure you are well-prepared and be there for you throughout the testimony.

The purpose of a mesothelioma claim is to demand compensation from the liable asbestos product manufacturers. Mesothelioma lawsuits are only one type of mesothelioma claim. The type of compensation you may be able to recover varies based on the type of claim you file.

Mesothelioma Personal Injury Lawsuits

The most significant compensation available in mesothelioma claims generally comes from mesothelioma lawsuits. In Minnesota, you have the right to pursue economic, non-economic, and punitive damages in a mesothelioma lawsuit.

Economic damages compensate for expenses and monetary losses, which typically include the following in mesothelioma cases:

- Medical expenses

- Domestic services

- Personal care services

- Medication costs

Non-economic damages compensate for intangible losses that cannot be measured in dollars. They include pain, suffering, mental anguish, loss of enjoyment of life, loss of bodily functions, and other things related to your quality of life.

Punitive damages are awarded by courts when you can show evidence that the asbestos product manufacturer engaged in outrageous conduct that contributed to your diagnosis. Punitive damages are harder to win, but our tenacious Minnesota mesothelioma attorneys have successfully won punitive damages in hundreds of cases.

Mesothelioma personal injury lawsuits may or may not make it to trial. We settle most of our cases, which is usually in the best interests of our clients. Settlement negotiations can begin early in a case, even before we file your lawsuit, but serious negotiations typically begin after the defendant has viewed your evidence.

The stronger your evidence, the stronger the likelihood of procuring a generous settlement. Having a competent Minnesota asbestos lawyer on your side will play an important role in helping you win the compensation you deserve without having to go to court.

Mesothelioma Wrongful Death Lawsuits

If you are the grieving family member of someone who has passed away from mesothelioma, you may be eligible to recover compensation in a mesothelioma wrongful death lawsuit. Wrongful death lawsuits are similar to personal injury lawsuits because they allow you to recover economic, non-economic, and punitive damages from the liable asbestos product manufacturers.

Economic damages in a wrongful death claim may include your loved one’s medical expenses, funeral and burial costs, and the loss of your loved one’s lifetime wages. Non-economic damages in a mesothelioma wrongful death lawsuit may include the following:

- Loss of companionship

- Loss of love and affection

- Loss of parental guidance

- Loss of advice, support, and comfort

- Your loved one’s pain and suffering

Minnesota law requires family members to petition the court to appoint a trustee to file a wrongful death claim rather than allowing family members to file directly. Our experienced Minnesota mesothelioma lawyers can help you with this process and provide your entire family with representation until your mesothelioma wrongful death lawsuit is resolved.

The court will distribute the proceeds to the surviving spouse and next of kin in proportion to each survivor’s loss.

Asbestos Trust Fund Claims

The large companies that mined asbestos and produced asbestos products became liable for a large number of mesothelioma cases after the coverup of the dangers associated with asbestos was exposed. Some of the companies experienced so many claims that they went bankrupt. These companies are protected from lawsuits.

If the companies responsible for your asbestos exposure are among the bankrupt companies, you cannot sue them. However, federal bankruptcy laws require bankrupt asbestos companies to establish trust funds for victims of asbestos exposure. Approximately $30 billion remains available in the asbestos trust funds.

Asbestos trust fund claims often provide a faster route to recovering compensation because you can file a claim directly against the fund rather than filing a lawsuit through the court system. Most funds allow you to choose between standard claims and fast-tracked claims.

You can recover economic and non-economic damages from the asbestos trust funds, but not punitive damages. Anyone who has been diagnosed with an asbestos-related illness may file a claim. Family members of asbestos exposure victims are also eligible.

Our trusted mesothelioma lawyers can identify all of the trust fund claims for which you are eligible and file those claims for you.

Mesothelioma VA Claims

If you have contracted mesothelioma or another asbestos-related illness and you were exposed to asbestos while serving in the military, you may be eligible to apply for VA benefits in addition to your mesothelioma lawsuit and trust fund claims.

To qualify, you must not be dishonorably discharged from the military, you must have a confirmed diagnosis, and you must have been exposed while serving. You will also need a statement from a doctor that verifies that your diagnosis is connected to your military service. This will establish it as a service-connected disability.

The types of benefits available vary based on your diagnosis, the dates of your military service, and your other income and resources. For example, you may qualify for one or more of the following benefits:

- VA Disability Compensation – Monthly tax-free payments you can receive if the VA has determined that you are disabled as a result of your diagnosis.

- VA Pensions – Monthly tax-free payments for veterans who served during wartime and have limited income and resources.

- Medical Care – Free medical care that may or may not have deductibles and copays, depending on your disability rating and resources.

Disability compensation is based on your disability rating. A disability rating is a percentage the VA assigns based on your overall health and function as it relates to a service-connected illness or injury. Higher ratings yield higher compensation.

As of 2024, the monthly compensation for an unmarried veteran with a 100 percent disability rating and no dependents is $3,737.85. This amount is higher if you have a spouse or other dependents.

Families of veterans who died from mesothelioma connected to military service may also receive VA benefits. VA benefits for surviving family members are known as Dependency and indemnity Compensation, or DIC.

You can apply for VA benefits through the Department of Veterans Affairs in person, by mail, or online.

Our Award-Winning Asbestos and Mesothelioma Attorneys

We have recovered more than $840 million in compensation for clients who have developed deadly diseases as a result of asbestos exposure. We understand the legal terrain in Minnesota and have witnessed firsthand the devastating toll a mesothelioma diagnosis takes on families.

When you choose our Minnesota mesothelioma law firm, you can expect superior service with a personalized touch. As a nationally recognized law firm with local roots, we have the ability to invest the same resources into your case as the large national law firms.

We help clients throughout the Upper Midwest, including Minnesota, North Dakota, and Wisconsin. Learn more by exploring our client testimonials and case results. Contact us today to schedule a free consultation.

Mesothelioma FAQs

Here are answers to some of the most frequently asked mesothelioma questions.

In Minnesota, if you’ve been diagnosed with mesothelioma due to asbestos exposure, you should consult with a specialized mesothelioma attorney. Your attorney will evaluate your case, gather evidence of exposure, and identify responsible parties, such as employers or manufacturers. They will then guide you through the legal process, filing the necessary documents in a Minnesota court, and either negotiate a settlement or present your case at trial.

The time limit for filing a mesothelioma claim is known as the statute of limitations. In Minnesota, you have six years from diagnosis for negligence claims and four years for product liability claims. For a wrongful death claim, the statute of limitations is three years.

Minnesota has a dedicated court to handle mesothelioma cases as quickly as possible, but it can still take months or more than a year to go to trial. Once you realize you have mesothelioma, you should contact a lawyer immediately.

Yes, you can still file a claim against bankrupt asbestos companies. Many companies that manufactured or used asbestos have declared bankruptcy due to the large number of asbestos-related claims filed against them.

When a company known for asbestos exposure files for bankruptcy, they’re often required to establish an asbestos trust fund. These trust funds were established to ensure that current and future victims of asbestos-related diseases, such as mesothelioma, can seek compensation even if the company is no longer in business.

No, you will not have to travel to meet with us. We understand the difficulty associated with travel when you are coping with a chronic illness or grieving the loss of a loved one. We will meet with you in your home, the hospital, or anywhere else that is convenient to you.

The length of time to recover your compensation will depend on the type of case you file. Mesothelioma lawsuits can take several months to a year or longer to resolve, depending on how willingly the asbestos product manufacturer takes responsibility. Trust fund claims can take anywhere from a few weeks to a few months. VA claims are processed in an average of three to four months.

Minnesota law allows family members to recover compensation in wrongful death lawsuits when the deceased would have been eligible to file a lawsuit had they survived. However, you will need a court-appointed trustee to file the lawsuit on your family’s behalf. Family members can also file trust fund claims and VA claims if the deceased qualified before death.

Family members can also continue claims that were initiated by their lost loved ones when the death occurred before the claim could be resolved.

Science has already established that asbestos exposure is by far the most common cause of mesothelioma. This means that if you have been diagnosed with mesothelioma, asbestos exposure is almost certainly the cause. The most important evidence you will need in a lawsuit includes your medical records confirming your diagnosis and your work history proving you were exposed to asbestos.

You don’t have to find proof before contacting our Minnesota mesothelioma attorneys. Since we began trying asbestos exposure cases in 1972, we have built a comprehensive database of asbestos exposure resources with internal company memos, purchase records, and other evidence that can help prove you were exposed to asbestos and show that the companies knew it was causing you harm.

Our Experienced Asbestos Lawyers Are Ready To Help

If you or your loved one has contracted mesothelioma in Minnesota or the Upper Midwest, you can count on our skilled mesothelioma lawyers to be there for you. Our legal team is dedicated to ensuring you get the best our nationally recognized law firm has to offer.

Contact us online or call us today at (651) 437-3148 to schedule your free consultation with an experienced Minnesota mesothelioma lawyer. You can also contact us via chat 24/7. Your initial consultation is free, and you pay nothing unless we collect compensation for you.